The importance of doing business with an entrepreneur who keeps his books clean.

May 11th, 2020

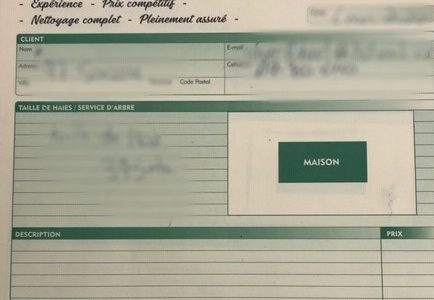

When paying your bill, a good bookkeeping will be felt with the exact amount, without surprise for the customer. This containing the beneficiary’s information as well as a brief description of the work. If there are corrections to be made, the follow-up will be done in a precise manner and some follow-up will be apparent. Proof that you are dealing with a company in good standing.

With a periodic billing cycle, there is a delay between the end of the work and the payment of the invoice. The customer who has adjustments or corrections can therefore before they are due, have them carried out. Usually the diligent contractor will carry out the corrective measures without problems. Unlike the seasonal worker paid cash without invoice who will not offer any after-sales service.

The main reason behind this complete documentation is that you must always keep it up to date and be able to provide the expenditure and income figures and extract the results. Coming from this calculation will come the contribution to our various governmental levels. Taxation, levies, wage deductions. By paying our taxes at the end of the year and collecting the taxes we contribute to our infrastructure and all our health and social services. On the worker side, salary deductions will have a beneficial effect for the company as much as for the employee who will be covered in several ways.

In short, when you choose a contractor, supplier, or service company, encourage those who have decided to follow the rules and operate in accordance with government laws.